Automotive Fuel Cell Market Size, Share, Trends & Global Forecast by 2030

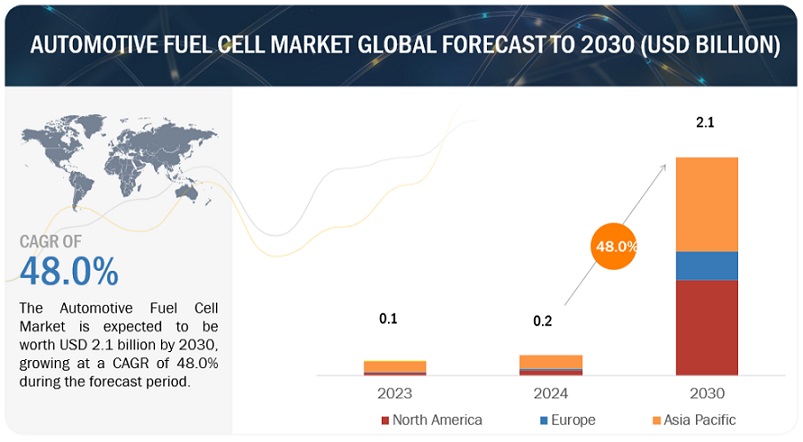

The global automotive fuel cell market is projected to grow from USD 0.2 billion in 2024 to USD 2.1 billion by 2030, at a CAGR of 48.0%.

Factors such as advancements in better fuel efficiency and increased driving range, rapid increase in investment and development for green hydrogen production, fast refueling, reduced oil dependency, and lower emissions compared to other vehicles are anticipated to contribute significantly to the revenue growth of the automotive fuel cell market. The evolution of fuel cell vehicles, combined with advancement in hydrogen technology, is poised to create favorable opportunities within this market.

Fuel Cell Hybrids with Battery Integration will form a promising product segment during forecast period

Fuel Cell Hybrid Electric Vehicles (FCHEVs) have emerged as a promising solution in the automotive fuel cell market, embodying a harmonious integration of fuel cell technology and secondary energy storage systems. Leading the way in this domain are upcoming models such as the Ford F-550 and H2X Warrego, showcasing the successful amalgamation of fuel cells and batteries in a single powertrain. These future models stand as pioneers, demonstrating the viability of FCHEVs, with automakers like Ford and H2X at the forefront. The popularity of FCHEVs is driven by their ability to address challenges faced by pure Fuel Cell Electric Vehicles (FCEVs). One of the key advantages of FCHEVs is their enhanced efficiency achieved by incorporating a secondary energy storage system, often taking the form of a battery. FCHEVs offer distinct advantages over their FCEV counterparts. Including a secondary battery facilitates smoother power delivery, reducing stress on the fuel cell and potentially extending its lifespan. Moreover, the presence of a battery enables energy recovery during braking, enhancing overall energy utilization. These factors make FCHEVs an appealing option for consumers looking for a cleaner and more efficient alternative to conventional vehicles. As technology advances and automakers refine their designs, FCHEVs are expected to play a crucial role in the transition toward sustainable and zero-emission transportation.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=14859789

Market Dynamics:

Driver: Enhanced Fuel Efficiency and Extended Driving Range

Fuel Cell Electric Vehicles (FCEVs) exhibit superior fuel efficiency compared to internal combustion engine (ICE) vehicles. FCEVs achieve approximately 63 miles per gallon gasoline equivalent (MPGge), outperforming ICE vehicles, which attain 29 MPGge on highways. Hybridization has the potential to enhance the fuel efficiency of FCEVs by up to 3.2%. In urban settings, FCEVs demonstrate a fuel economy of approximately 55 MPGge, contrasting with the 20 MPGge observed in ICE vehicles. Notably, FCEVs and Battery Electric Vehicles (BEVs) display significant differences in driving range. FCEVs can cover nearly 300 miles without refueling, whereas the average BEV range is approximately 110 miles on a fully charged battery. The Honda Clarity stands out with the highest EPA driving rating among zero-emission vehicles in the US, boasting an impressive driving range of up to 366 miles. The combination of enhanced fuel efficiency and extended driving range is anticipated to drive increased demand for FCEVs, consequently influencing the automotive fuel cell market positively. Hydrogen, with a specific energy of 40,000 Wh/kg, surpasses conventional Li-ion batteries, which only have about 250 Wh/kg. Charging times further distinguish FCEVs from conventional BEVs, as FCEVs can refuel in approximately 5 minutes, while BEVs typically require more time for a full charge. The overall calculated efficiency of an FCEV is estimated to be around 60%.

Opportunity: Hydrogen Fuel-Cell Vans to be a emerging market opportunity

As conventional fuel prices surge, the automotive industry is witnessing a shift towards hydrogen-powered vehicles, particularly fuel-cell vans. Companies such as Hyvia, Hyundai, and Bosch are introducing hydrogen-fueled vans, like the Renault Master VanH2 Tech and Hyundai’s hydrogen-powered vans and buses. These vehicles boast impressive ranges, addressing concerns about the rising operational costs of traditional internal combustion engine (ICE) vans. Simultaneously, governments globally are taking significant initiatives to promote fuel-cell technology and invest in hydrogen infrastructure. Regions like Europe, China, and North America, along with U.S. states like California and New York, are actively contributing to the development of hydrogen hubs. Moreover, the market is witnessing mobile and community hydrogen fueling systems innovations, making hydrogen more accessible for residential and small-scale use. Companies like Air Liquide, Linde, and Powertech Labs are pioneering the development of cost-effective and mobile refueling solutions to drive the adoption of fuel-cell electric vehicles further in the market.

Fuel Stack to act as growth catalysts in the Automotive Fuel Cell Market

The rapid growth of the automotive fuel stack market can be attributed to several factors, including stringent emissions regulations, government incentives, technological advancements, and diverse applications of fuel cell vehicles (FCVs). The fuel cell stack, a crucial fuel cell system component, consists of two flow field plates and a Membrane Electrode Assembly (MEA). It generates electricity in the form of direct current (DC), requiring a DC/AC converter for conversion into alternating current (AC) suitable for AC applications in Fuel Cell Electric Vehicles (FCEVs). An individual fuel cell produces less than 1.16 V of electricity in automotive applications. Multiple fuel cells are stacked together to enhance power generation, forming what is commonly known as a fuel cell stack. The fuel cell stack is considered the fuel cell system’s most expensive component due to platinum’s inclusion. The stack size determines the fuel cell’s power output, and increasing the number of fuel cell stacks can amplify power generation. Stacks are equipped with end plates and connections for integration into Fuel Cell (FC) modules. As the stack size increases, the cost per unit of power generated decreases, making fuel cells an efficient option for long-range transportation.

The industry adheres to the principle of economies of scale, whereby higher production volumes result in lower per-unit costs.Companies such as Ballard Power Systems and PowerCell AB have been actively engaged in the development of fuel cell stacks. For instance, in September 2020, Ballard Power Systems introduced the high-power density fuel cell stack, FCgen HPS, designed for vehicle propulsion, particularly in medium and heavy-duty vehicles. In July 2022, PowerCell announced a partnership with ZeroAvia, involving the delivery of 5000 units of 100 kW fuel cell stacks starting in 2024. ZeroAvia plans to utilize these fuel cell stacks to produce a 600 kW, low-temperature hydrogen-electric powertrain for a 19-seat commercial aircraft.

Europe is expected to be the fastest growing hydrogen infrastructure provider in the coming years

Europe is experiencing rapid growth in the hydrogen fuel points market, with Germany and France leading the expansion. Other countries like the UK, Belgium, Denmark, Italy, Norway, Netherlands, Spain, Sweden, and Switzerland are also contributing to the market’s growth. The increase in fueling stations is driven by new emission reduction policies. Germany, in particular, has seen significant growth due to collaborations between German OEMs and the government, resulting in an increase in fuel cell electric vehicles (FCEVs). France has worked with Germany to enhance hydrogen fueling points. Shell subsidiaries have approved the construction of Holland Hydrogen L, set to become Europe’s largest renewable hydrogen plant in 2025. In 2022, 82 MOBILITY secured 110 million euros to expand large hydrogen refueling stations, with notable investments from Shell, Air Liquide, Daimler Truck, EG Group, and Hyundai.

Key Players

The major players in Automotive Fuel Cell Market include Ballard Power Systems (Canada), Hyster-Yale (US), Plug Power (US), ITM Power(UK) and Cummins (US), among others. These companies have strong product portfolio as well as strong distribution networks at the global level.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=14859789

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/automotive-fuel-cell-market-14859789.html